Promoting high-quality development of enterprises in deepening reform (observation of production and marketing)

Source: State-owned Assets Supervision and Administration Commission of the State Council

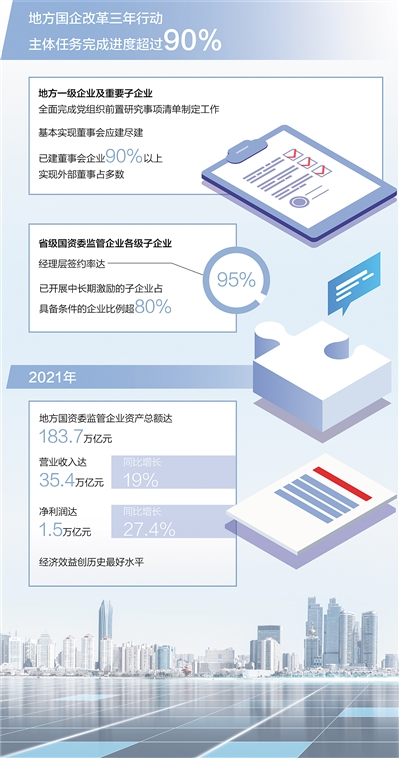

Since the implementation of the three-year reform of state-owned enterprises, the leading groups of state-owned enterprise reform in various places have promoted the reform in an all-round way and made many breakthroughs. At present, the progress of completing the main tasks of the three-year reform of local state-owned enterprises has exceeded 90%. In 2021, the total assets of local SASAC-supervised enterprises reached 183.7 trillion yuan, with operating income and net profit reaching 35.4 trillion yuan and 1.5 trillion yuan respectively, up by 19% and 27.4% respectively, and the economic benefits reached the best level in history.

What experiences and practices have been formed and what positive progress has been made in the reform of local state-owned enterprises? A few days ago, the reporter interviewed Baotou Steel, Guangzhou Automobile and Shaanxi Fiberhome Electronics.

— — Editor

Baotou Steel (Group) Company — —

Follow the market rules and enhance endogenous power

Our reporter Liu Zhiqiang.

In February, 2021, we installed ammonium sulfate intelligent manufacturing electrical equipment independently, saving 28,168 yuan; In November 2021, the desulfurization cable was repaired, saving 15,090 yuan; In total, the annual savings exceeded 1 million yuan … … A table records in detail the cost reduction effect of industrial control network section of coal coke chemical branch of Baotou Steel in 2021. "Get started by yourself, repair the old and waste, and repair the equipment, both ‘ Hey ’ Out of the cost, it also makes the work more fulfilling. " Xing Gang, section chief of the industrial control network, said.

Reduce financial costs, manufacturing costs, logistics costs, and labor costs, and improve asset operation efficiency and work efficiency. Since 2019, Baotou Iron and Steel (Group) Co., Ltd. has started to implement the "four reductions and two lifts" project, clarifying tasks step by step and post by post, with full participation, reducing costs and increasing efficiency, and reducing various costs by more than 9 billion yuan.

"There is pressure and more motivation." In Xing Gang’s view, reducing costs and increasing efficiency can be implemented, behind which the incentive mechanism has improved the enthusiasm of employees. "Everyone has reduced costs by optimizing production processes and eliminating hidden dangers of equipment, and will receive special rewards, which is also conducive to promoting ranks and improving salaries."

As an old state-owned enterprise with a history of more than 60 years, Baotou Steel once fell into huge losses around 2016. During the three-year reform of state-owned enterprises, Baotou Steel, under the guidance of the State-owned Assets Supervision and Administration Commission of Inner Mongolia Autonomous Region, made a "combination boxing" of the reform of slimming, reducing costs and increasing efficiency and strategic transformation, and gradually turned losses into profits and got out of the predicament. In 2021, Baotou Steel achieved an operating income of 126.036 billion yuan and a profit of 10.36 billion yuan, increasing by 44.75% and 579.19% respectively compared with 2018, and all indicators reached the best level in history, becoming the first state-owned supervision enterprise in Inner Mongolia Autonomous Region with a revenue exceeding 100 billion yuan.

"Being in a completely competitive industry, Baotou Steel must take greater reforms and touch deeper contradictions if it wants to turn losses into difficulties." Wei Shuanshi, secretary of the Party Committee and chairman of Baotou Steel (Group) Company, believes that the essence of reform is to follow the laws of the market and let the market-oriented mechanism really play its role.

On the one hand, we should lose weight and keep fit, deal with difficulties and do a good job of "subtraction" in resource allocation to enhance market competitiveness.

In recent years, Baotou Steel has disposed of eight "zombie enterprises" by taking measures such as asset reorganization, property right transfer and bankruptcy, involving assets of 1.49 billion yuan. At the same time, scientifically dispose of inefficient and ineffective assets and classify idle assets. Since 2016, 402 idle assets have been publicly disposed of through the market-oriented property rights trading platform, with an asset appreciation of more than 32 million yuan. At the same time, we will build a more advanced and environmentally friendly production line, and Baotou Steel will steadily realize transformation and upgrading.

On the other hand, optimize incentives, scientifically decentralize, and do a good job of "addition" in endogenous motivation to enhance the development potential of enterprises.

In November, 2021, researchers of Baotou Rare Earth Research Institute, a subsidiary of Baotou Steel, welcomed good news: the research institute appraised the technical achievements of "Rare Earth PVC Heat Stabilizer" at a price of 12.75 million yuan, and established a joint venture of Northern Rare Earth Ruihong Company, and 70% of the equity formed by the technology was awarded to the researchers. "In addition to equity incentives, there are short-term timely rewards for achievements, dividend incentives for achievements transformation, and differentiated salary mechanisms and scientific research projects ‘ Reveal the list ’ The mechanism and incentives are more and more perfect. " Li Bo, vice president of Baotou Rare Earth Research Institute, said.

While stimulating the enthusiasm of researchers, Baotou Steel also decentralized all units to introduce high-level talents on their own, especially those who are in urgent need of enterprise development. In 2021, Baotou Rare Earth Research Institute established Hangzhou Branch with the support of the Group to create a "talent enclave". "Establishing a branch can not only strengthen the docking cooperation with local universities and scientific research institutions, but also effectively solve the problem of attracting talents." Li Bo told reporters that in the past two years, the branch has attracted many high-level talents to join. "In December last year, we successfully hired high-end talents in the rare earth industry and professors from Zhejiang University to strictly serve as the dean of the Rare Earth Research Institute, realizing the professionalization of cadres."

Ability determines position, efficiency determines employment, and contribution determines salary. In recent years, Baotou Steel has carried out three institutional reforms to comprehensively enhance the endogenous motivation of enterprises — —

Let cadres go up and down. In Inner Mongolia Autonomous Region, we took the lead in pushing forward the market-oriented hiring and contractual management, took out 53 full-time posts and 178 deputy posts, openly recruited talents to attract talents to the society, signed letters of responsibility with managers of 100 holding subsidiaries, and set contractual indicators scientifically and reasonably.

Let employees get in and out. Improve the differentiated assessment and evaluation mechanism, implement rigid withdrawal for incompetent people, and terminate labor contracts for those who violate discipline and law.

Let the income increase and decrease. The salary distribution highlights the marketization in an all-round way, instead of simply "looking at status" and "looking at rank". The monthly income of employees fluctuates by more than 10%, and the salary gap of middle-level cadres reaches nearly 8 times. Since 2016, the income of employees on the job has increased by 62%.

"Through reform, Baotou Steel has gradually embarked on a benign development track and has the conditions and foundation to move towards a higher level. In the next step, we must step by step to deepen the reform and make continuous progress towards the goal of building a first-class domestic enterprise. " Wei Shuanshi said.

Guangzhou Automobile Group — —

Perfecting governance mechanism and enhancing competitive strength

Our reporter Wang Zheng

Recently, Guangzhou Automobile’s reform measures have been frequent: 794 important technicians and management personnel have been included in the scope of employee equity incentives, accounting for about 20%; At the same time, strategic investors such as Chengtong Group and Nanwang Kinetic Energy were introduced, raising 2.566 billion yuan, laying the foundation for completing the A round of financing and shareholding system reform before the third quarter of this year.

"Establishing a more market-oriented corporate governance structure, a more competitive equity structure and a long-term incentive mechanism to fully stimulate the vitality of enterprises and the enthusiasm of employees is the main purpose of GAC Ai’ an to carry out mixed ownership reform." The relevant person in charge of Guangzhou Automobile Group Co., Ltd. said.

In recent years, Guangzhou Automobile Group, as the first large state-controlled automobile group with A+H shares listed as a whole in China, has continued to exert its efforts in the new corporate governance mechanism and actively explored the construction of modern enterprise system with China characteristics.

— — Strengthen the board of directors and forge the main body of corporate governance decision-making.

How to promote the diversified sources, reasonable structure, effective checks and balances and efficient operation of the board of directors is a major issue in the construction of modern enterprise system of Guangzhou Automobile Group.

In order to build an excellent board of directors, Guangzhou Automobile Group strengthened the top-level design and improved the system of selecting and appointing directors. Broaden the channels of talent introduction and establish a talent pool for directors; Insist on selecting the best among the best and strictly screen directors. At present, among the group’s 11 directors, 3 external directors are senior executives in the automobile industry and finance nominated by minority shareholders, and 4 independent directors are well-known experts in the fields of law, financial accounting and strategic management at home and abroad. At the same time, the Group has also established a team of 160 external directors, and promoted all the 108 subsidiaries at all levels included in the scope of construction to set up boards of directors, with 100% external directors in the majority.

In order to strengthen the protection of directors’ performance of duties and fully implement the functions and powers of the board of directors, Guangzhou Automobile Group has improved relevant systems, established a follow-up feedback mechanism for directors’ opinions, and formulated measures for the management of funds of the board of directors to provide a strong guarantee for directors to perform their duties. Implement the major decision-making power of the board of directors, give play to the role of the four special committees under the board of directors, namely, strategy, audit, remuneration and assessment, and nomination, and ensure that the decision-making power and supervision power of the board of directors are implemented.

— — Promote the reform of professional managers and transform the governance mechanism.

How to establish a more market-oriented selection and employment mechanism through the implementation of professional manager pilot at the group level is another major issue for Guangzhou Automobile Group to cope with fierce market competition.

In July 2018, Guangzhou Automobile Group became the first state-owned enterprise in Guangzhou to implement the reform of professional managers, and successively completed the selection and appointment of eight professional managers in three batches by means of internal transfer and open recruitment. On April 2 this year, the Group openly recruited three deputy general managers for the society, which achieved a new breakthrough in the reform of professional managers of the Group.

Through the reform of professional managers, Guangzhou Automobile Group has made it clear that the investment of major projects under 500 million yuan in the business plan will be decided by the management, and 27 general managers and 7 deputy managers will exercise their functions and powers, giving the management the right to operate independently more flexibly and quickly in response to market changes.

Guangzhou Automobile Group has also established a selection, employment and distribution system of "being able to enter and exit, being able to go up and down, and being able to have high energy and low energy" at the management level, formulated a salary management mechanism of "double benchmarking of salary and performance, combining short-term and long-term", and strictly implemented the rigid payment principle of "performance up, salary up, performance down and salary down", the market-oriented salary distribution principle of "incremental performance and incremental salary" and the differentiated post salary principle. At the same time, improve the medium and long-term incentive mechanism. In 2020, professional managers will be granted stock options and restricted shares totaling 3.5 million shares.

In recent years, the construction of modern enterprise system with China characteristics has led Guangzhou Automobile Group to achieve high-quality development. In 2021, Guangzhou Automobile Group achieved a revenue of 429.8 billion yuan and a total profit of 26.2 billion yuan, ranking 176th among the world’s top 500 enterprises. 1-mdash this year; In April, the cumulative sales of two independent brands, Guangzhou Automobile Chuanqi and Guangzhou Automobile Ai ‘an, were 111,000 and 55,000 respectively, up by 10.6% and 112.6% respectively.

Shaanxi Fiberhome Electronics — —

Changing R&D Mode and Stimulating Innovation Vitality

Our reporter Zhang Danhua

Walking into the exhibition hall of Shaanxi Fiberhome Electronics Co., Ltd., a blue communication hat stands out. Not long ago, the astronaut Shenzhou XIII who returned to Earth was wearing this comfortable elastic net cap. "When the astronauts were out of the cabin, the communication cap and voice device of the spacesuit we developed played a key role." Song Tao, chairman of Fiberhome Electronics, told the reporter that the astronauts’ communication caps and voice processing devices are wrapped in spacesuits. Through voice signal processing, active noise reduction and other technologies, the noise inside spacesuits can be overcome, allowing astronauts to pick up and receive voice more clearly.

High-tech products can not be separated from the positive contributions of scientific researchers. Since the implementation of the three-year reform of state-owned enterprises, Fiberhome Electronics, a subsidiary of Shaanxi Electronic Information Group, has actively explored new modes of scientific research management and taken various measures to stimulate the vitality of scientific research teams.

"Before the reform, the biggest problem we faced was the shortage of talents." The enterprise is located in Baoji City, Shaanxi Province, and some well-known college graduates are reluctant to come to work, which once made Song Tao a headache.

"Where talents are willing to work, we will build the R&D center." In order to attract more outstanding scientific research talents, Fiberhome Electronics has established a research and development center in Zhongguancun Integrated Circuit Industrial Park, Beijing, forming a research center based on Beijing — Xi ‘an — Baoji-based R&D strategic layout has also established special scientific research centers in Chengdu, Nanjing, Guangzhou and other places, which has attracted high-tech talents to become an important force for enterprise innovation.

While improving the layout, Fiberhome Electronics has also changed the traditional management mode of scientific research projects, and stimulated the innovative vitality of scientific researchers through the project manager responsibility system.

According to reports, in the traditional R&D model, the technical chief, as the first person in charge of the project, looks for technology applications needed by the market, and then the R&D center is responsible for technical research. The R&D team is only responsible for technology, and does not undertake the functions of market and finance. Sometimes, there is a problem of low willingness to cooperate with the technical chief engineer, and it cannot respond to the market demand quickly.

Different from the traditional research and development model, the project manager responsibility system takes the scientific research project manager as the core. Both the technical chief engineer and the R&D personnel can become the first responsible person of the project through the mechanism of "revealing the list and taking the lead" after accurately positioning the market demand, and sign the responsibility letter of the project objectives with the company to clarify the rights and responsibilities. In this way, the project manager is given the autonomy of team building, project performance evaluation and reward distribution, actively responds to customer needs externally, and is responsible for product research and development internally, forming a flat organizational system with multiple functions.

"The traditional mode is vertical management, and I have to ask for instructions in every detail. My phone keeps ringing all day. Since the implementation of the project manager system, my mobile phone has been quiet. " Song Tao laughed.

Company executives received less instructions, but the innovation vitality of grass-roots scientific research institutions was more sufficient. At the beginning of 2021, after the overall project of Fiberhome Electronic Joint Search and Rescue System was launched, the project manager of "Revealing the List" set up a project team of more than 10 people from the "resource pool" of the company’s R&D center. After that, the project team successfully bid for the outside world, and everyone worked hard together. "After the successful bidding, the company gave the team a reward of 700,000 yuan in accordance with relevant regulations. I look forward to a good profit after the project is completed, so there will be more income. " The project manager said.

Effective incentives come from scientific mechanisms. During the three-year operation, Fiberhome Electronics broke the "big pot" and divided the salary of researchers into three items: basic salary, performance and profit commission after the completion of the project, of which the latter two items were all linked to the scientific research projects undertaken by individuals, and "the bottom is not covered, and the top is not capped", realizing the transformation from "paying wages" to "earning wages". In 2021, the salary gap of R&D personnel in the company widened to seven times, and some R&D personnel were paid more than company executives.

Deepen the reform, so that the innovation vitality of scientific research personnel is full of generate, and Fiberhome Electronics has also gained innovative achievements such as joint search and rescue system and a certain life-saving radio station. In the past three years, the company has been granted 107 patents, including 43 invention patents and 4 national standards, and has also been successfully selected as a single champion enterprise in Shaanxi Province.