People’s leaders | for the youth

A far-sighted political party always pays more attention to the youth.

"The CPC Central Committee is very concerned about people’s livelihood. People’s livelihood is first and foremost employment. We are particularly concerned about the employment of college graduates." On June 8, 2022, the figure of the Supreme Leader General Secretary appeared in the Qiushi Hall of Yibin College.

The general secretary asked the teachers, students and business leaders who were attending the enterprise recruitment seminar to understand the recruitment needs of enterprises and the signing rate of graduates. He urged schools, enterprises and relevant departments to do a good job in the implementation of student employment contracts, "especially focusing on poverty-stricken families, low-income families, zero-employment families and disabled college graduates who have not been employed for a long time."

On June 8, 2022, General Secretary of the Supreme Leader waved to the teachers and students during his inspection in Yibin College.

Aim for the future career, mostly for the youth.

"Young people are in the initial stage of life, and they often encounter various difficulties and distress in their study, work and life, and they need the help of the society in time." Since entering politics, the supreme leader has always been concerned about the thoughts, worries and hopes of young people.

When the supreme leader was working in Zhengding, he once went to Liucun Table Tennis Amateur Sports School for investigation, and learned that there was a young coach in the sports school who was excellent and responsible, and brought out students selected for the national team, but his salary was very low. The sports school hopes that the organization can help her solve some difficulties. At 11 o’clock in the morning, the supreme leader left the village with relevant materials. At 3 pm, the sports school was informed — — The county raised the young coach’s salary by one level. The first sentence written on the approval is "to encourage young people to study hard".

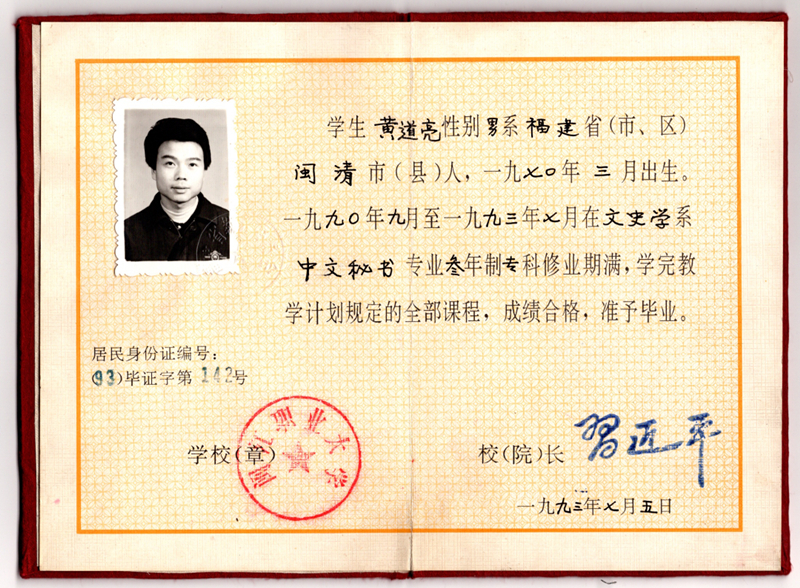

In the memories of youth of Huang Daoliang, a graduate of Minjiang Vocational College, there is also an unforgettable thing. Huang Daoliang lost his arms in an accident when he was young. Although his scores in the college entrance examination reached the big special line twice in a row, no school was willing to admit him. In 1990, Huang Daoliang took the college entrance examination for the third time. His father wrote a letter to Minjiang Vocational College about his children’s schooling experience. At that time, the supreme leader who was the secretary of Fuzhou Municipal Party Committee was also the president of Minjiang Vocational University. Under his care and coordination, Huang Daoliang realized his university dream and became the first college student without arms in Fujian.

Huang Daoliang’s diploma.

"We should pay attention to the thoughts, worries and expectations of young people, help them solve their worries and troubles in graduation job hunting, innovation and entrepreneurship, social integration, marriage and friendship, support for the elderly, children’s education, etc., and strive to create good development conditions for young people, so that they can feel that care is around and care is in sight."

General Secretary of the Supreme Leader said this and did the same. In his view, pressure is the driving force for the growth of young people, and giving a hand at the key point and when it is important may be an important fulcrum for young people to overcome pressure and develop into talents.

In today’s China, the pace of social development is very fast, and people’s work and life are also under great pressure. The general secretary is very considerate of young people and is committed to "creating a warm and harmonious social atmosphere, expanding inclusive and active innovation space, and creating convenient and comfortable living conditions, so that everyone can have a happy mood, make their lives brilliant and make their dreams come true".

Joining the team, joining the League and joining the Party is a "trilogy of life" for contemporary China youth to pursue political progress. From the perspective of ensuring that the red mountains and rivers will never change color, the General Secretary demands that the education chain of the party, the league and the team be connected and connected. He said that the Communist Party of China (CPC) has always opened its doors to young people and warmly welcomes them to become the fresh blood of the Party.

The General Secretary of the Supreme Leader has high hopes for the youth, advocates looking at the innovation and creation of the youth with appreciation and approval, actively supporting them to shine in life, and praising and applauding the achievements and achievements of the youth.

In June, 2021, the General Secretary walked into beijing aerospace control center and had a cordial conversation with the Shenzhou-12 astronaut who was on a business trip in space. At that time, there were many "post-80s" and "post-90s" aerospace scientists and technicians who provided technical support services for this "dialogue between heaven and earth", which made people see the vigorous strength of the younger generation. A few months later, at the Central Talent Work Conference, the General Secretary mentioned this detail. "Most of them are young people in their thirties and forties, but they are all responsible for important positions." The words are full of pride.

Young scientific and technological talents of beijing aerospace control center dispatching team shot on July 1st, 2022.

Mountains and rivers are the evidence, and years are the name.

In 2015, the General Secretary presided over the first Central Party group work conference in the history of the Party, which opened the curtain of deepening the reform of the Communist Youth League.

In 2017, the first youth development plan in the history of New China, which was personally directed by the General Secretary, was released, which made a strategic plan for youth development from the top design level.

… … … …

Socialism with Chinese characteristics has entered a new era, and the Supreme Leader General Secretary has always been based on the far-reaching consideration of "ensuring the party’s cause from generation to generation and ensuring the sustainable development of the Chinese nation", guiding the growth of youth and deploying youth work.

In the new era, young people in China have more equal educational opportunities, rich and diverse career choices, smooth development and free flow, and a wider stage to realize their brilliant life. Taking the education level as an example, the data show that in 2023, the consolidation rate of nine-year compulsory education reached 95.7%, the gross enrollment rate of high school reached 91.8%, the gross enrollment rate of higher education reached 60.2%, and the total number of students in school reached 47.6319 million, so more and more young people opened the door to success.

On June 26th, 2023, China Renmin University filmed the scene of the 2023 doctorate awarding ceremony.

From the oath of "building a country with youth" to the self-confidence of "please rest assured that the powerful country has me" … … With the changing scene of the times, the young people in China in the new era meet the best period of the development of the Chinese nation, have a better development environment and a broader growth space, and are faced with a rare life opportunity to make contributions.

On the new journey, the Supreme Leader’s General Secretary is far-sighted. "We are determined to achieve a good result for the youth, and we also expect the younger generation to achieve better results in the future."