First bottoming out, then rising —— Predicting the trend of domestic interest rate in the next few quarters

Full text10074Words, reading takes abouttwentyminute

Macro Team of Wencaixin Research Institute

Wu Chaoming and Hu Wenyan

Core view

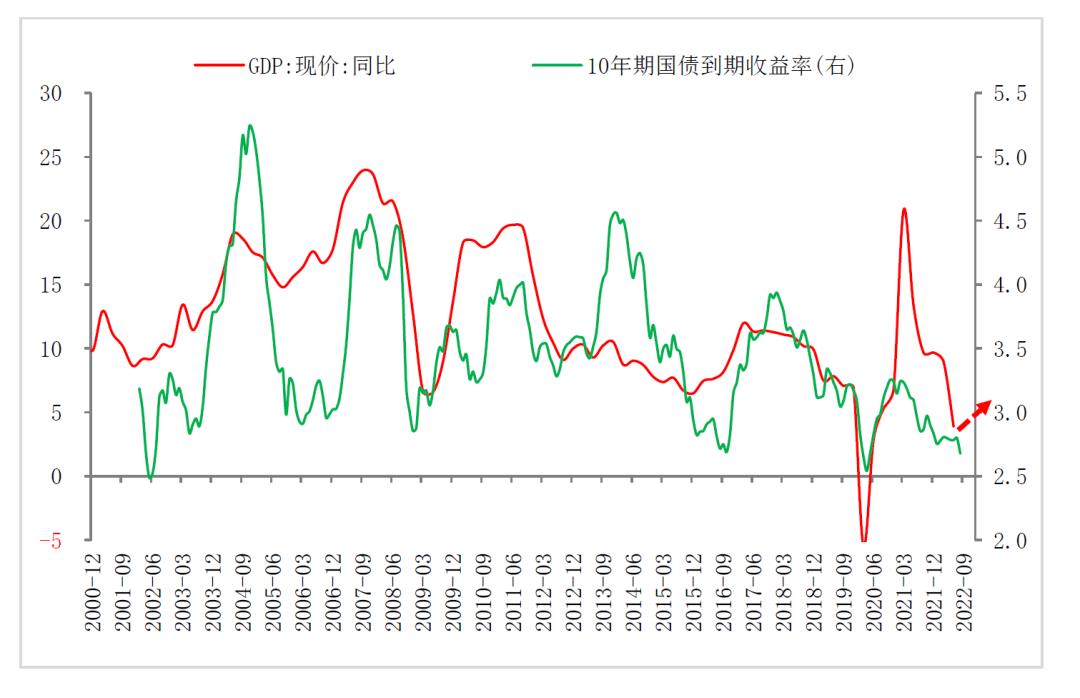

How will the domestic interest rate, especially the yield of ten-year treasury bonds, be interpreted in the future? The market has little disagreement on the medium and long-term trend. Most people think that the interest rate will follow the shift of GDP, especially the nominal GDP growth rate, and show an overall downward trend. However, the market has great differences and different judgments on the short-term trend in the next few quarters.

1. China’s interest rate analysis framework: fundamental factors such as economic growth and inflation dominate the direction of interest rate change, while other factors such as financial supervision policies and exchange rates affect the fluctuation range of interest rates.One isIn the medium and long term, the yield trend of domestic ten-year government bonds is basically consistent with the growth rate of nominal GDP and the running trend of inventory cycle, indicating that the trend of domestic interest rates is mainly dominated by fundamental factors such as economic growth and prices.The second isAfter the international financial crisis in 2008, the goal of financial stability has also become an important factor affecting interest rates. In the cycle of stable economic growth, especially economic recovery, strict supervision and the policy tendency of reducing leverage will lead to a significant increase in market interest rates.The third isInterest rates will also be affected by exchange rates, supply and demand of funds and other factors. For example, the continuous interest rate hike by the Federal Reserve will restrict the domestic monetary easing space, and the demand for funds exceeding supply will also raise the level of interest rate centers.

Second, the trend of domestic interest rates in the next few quarters: it is expected that the fluctuation will bottom out first, and then the probability of recovery will be too high.

First, from the perspective of interest rate analysis framework, the yield of 10-year government bonds may bottom out first and then rise.First,The probability of weak economic recovery in the second half of the year is too high, which determines that it is difficult for interest rates to rise sharply in the short term, or to bottom out first, but after the economy is confirmed to stabilize and rise, interest rates will tend to rise;Secondly,Affected by factors such as the resonant upward trend of pig grain price, high oil price, recovery of consumer demand and abundant liquidity, it is expected that CPI will continue to fluctuate around or even above 3% from the second half of this year to the first half of next year, which will support the upward trend of interest rates;Third,The continuous upside-down spread between China and the United States and the transformation from a wide currency to a wide credit will also increase the upward pressure on domestic interest rates.

Second, from a quantitative point of view, the current yield of ten-year government bonds is lower than the desired interest rate, and it is only a matter of time before it gradually converges upward in the future.

Third, based on the historical experience in 2012 and 2019, the interest rate cut on the eve of economic recovery will help the interest rate to decline slightly in the short term. However, if there is no unexpected impact, after the interest rate cut boots land and the economic confirmation stabilizes, the interest rate will enter the recovery channel.In July this year, the domestic economy recovered weakly, which led the central bank to cut interest rates unexpectedly in August. If the real estate recovery continues to fall short of expectations, the possibility of cutting interest rates again will not be ruled out. However, with the steady growth policy taking effect, the probability of China’s credit demand bottoming out and economic recovery improving in the future is increasing, and the trend of interest rate bottoming out in the next few quarters is more clear.

Risk warning:Real estate recovery continued to fall short of expectations, and the overseas economy went down more than expected.

main body

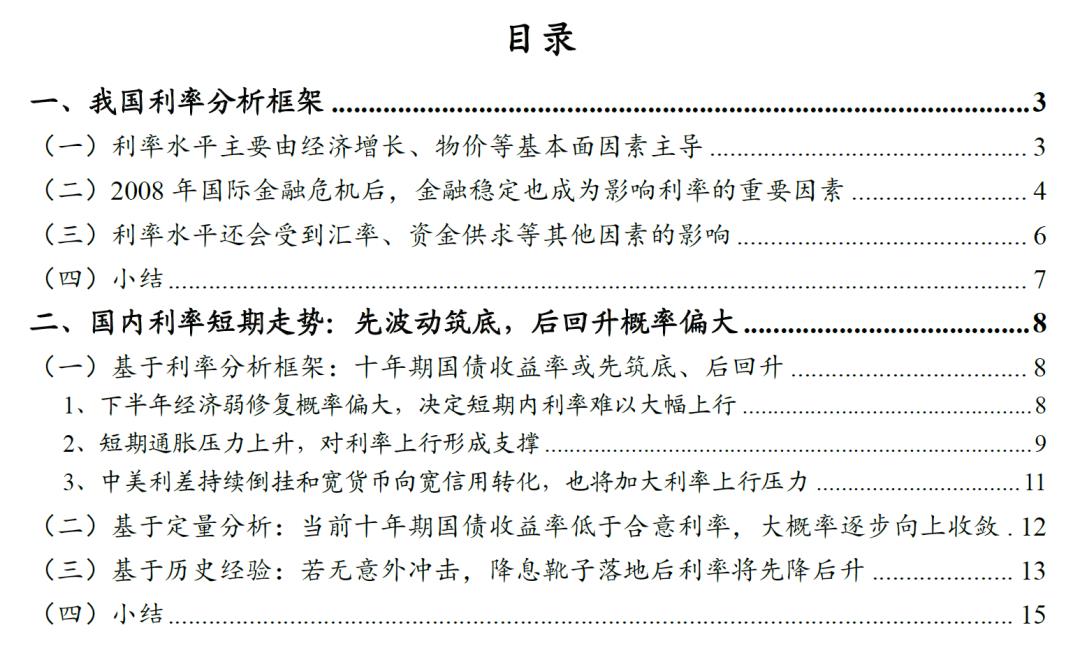

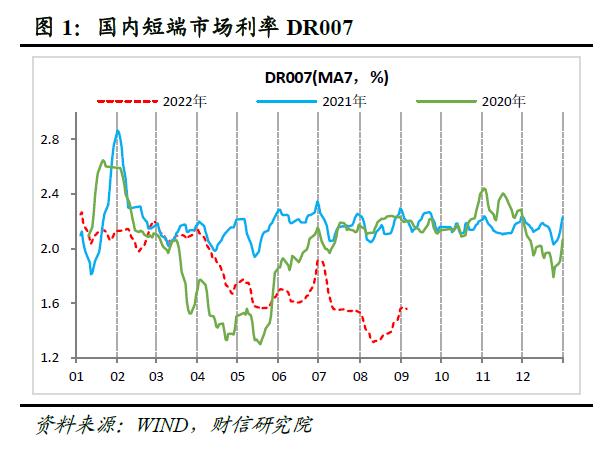

Since the beginning of this year, the domestic market interest rate has experienced two obvious downturns: First, in April-May, 2022, in the face of the severe impact on the economy brought by the conflict between Russia and Ukraine and the rebound of the epidemic, the central bank greatly increased the liquidity supply to boost the demand for entity financing and support the economic recovery as soon as possible. The domestic short-term market interest rate DR007 dropped from about 2.1% in the first quarter to around 1.5%, which was about 60BP lower than the policy interest rate in the same period (see Figure 1). Second, from July to August, due to the unexpected economic recovery, especially the overall weakening of financial and economic data in July, and the prominent problem of insufficient effective social demand, the central bank unexpectedly cut interest rates in mid-August, pushing the interest rate of DR007 down from about 1.9% at the end of June to the historical low of 1.3% during the outbreak of the epidemic in 2020, and the yield of 10-year government bonds also broke through the low point in the same period to further open up the downside (see Figure 1-2).

Looking forward to the future, the market has little difference on the medium and long-term trend, and most people think that the interest rate will follow the shift of GDP, especially the nominal GDP growth rate, showing an overall downward trend, but the market has great differences and different judgments on the trend in the next few quarters. Therefore, based on the interest rate analysis framework and quantitative analysis, this paper studies the trend of domestic interest rates in the next few quarters.

First, China’s interest rate analysis framework

(1) The interest rate level is mainly dominated by fundamental factors such as economic growth and prices.

According to the People’s Bank Law, the ultimate goal of China’s monetary policy is to "maintain the stability of the currency and promote economic growth". As a big country economy, China’s monetary policy is dominated by me. Interest rate is one of the key tools to achieve the goal of monetary policy, so the formulation of domestic interest rate policy and the trend of interest rate level mainly depend on economic fundamental factors such as economic growth and prices in the medium and long term.

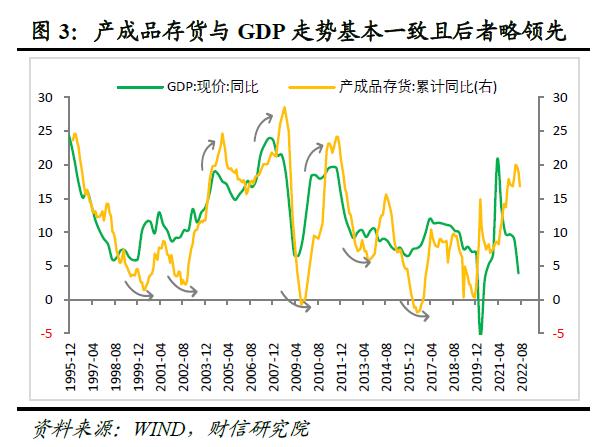

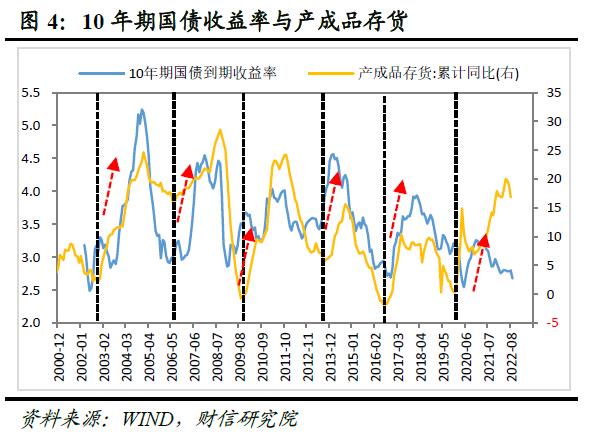

First, the trend of domestic interest rate is basically consistent with the growth rate of nominal GDP and the running trend of inventory cycle.Inventory cycle describes the periodic change of enterprise inventory for about 40 months, which can be used to help judge the strength of economic growth because of its strong correlation with nominal economic growth (see Figure 3). Since 2003, China has experienced a total of five complete inventory cycles, and is currently in the sixth cycle of the inventory cycle (see Figure 4). Generally speaking, the upward cycle of inventory often corresponds to the recovery stage of interest rate, that is, the bear market in the bond market, and vice versa. However, it is worth noting that the peak and trough of interest rate and inventory cycle are only similar at the time point, but not completely consistent. In most cases, interest rate is slightly ahead of the latter to peak or bottom. On the one hand, this stems from the fact that the growth rate of inventory lags behind the economic growth slightly (see Figure 3), and on the other hand, it is also related to the interest rate being affected by other factors such as investors’ expectations. In addition, there is no fixed proportional relationship between interest rate fluctuation range and inventory fluctuation range, and they only have the same trend, indicating that economic growth is not the only factor determining interest rate.

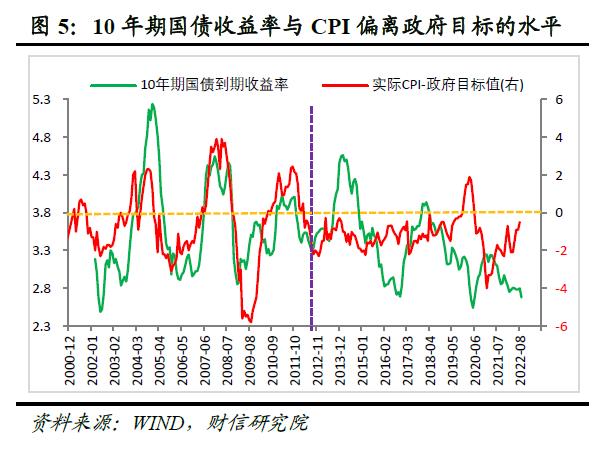

Second, there is a strong correlation between interest rate trend and inflation gap in history, but the correlation tends to weaken in recent years.In order to stabilize inflation and its expectation, China will put forward this year’s CPI growth target in the government work report every year. If the price deviates far from the above target value, monetary policy will take effective measures to promote the price to return to the target center. From the practical experience, before 2013, the yield of domestic ten-year government bonds and the inflation gap (CPI growth rate-government target growth rate) basically changed synchronously, and the correlation between them was very strong (see Figure 5). However, after 2013, due to the obvious reduction of domestic CPI fluctuation, the inflation gap basically fluctuated around 0, the monetary policy was weakened by price constraints, and the correlation between the inflation gap and the yield of 10-year government bonds was also obviously weakened. If we consider the relationship between the comprehensive inflation index weighted by CPI and PPI and the yield of 10-year treasury bonds, the correlation between the two has also weakened after 2013, and the peaks and valleys of the two are close at the time point but no longer completely consistent (see Figure 6). On the whole, when the inflationary pressure is high, the interest rate is more constrained by the price, which is more consistent with the price trend, and vice versa, which shows that inflation is one of the important factors in determining the interest rate.

(B) After the international financial crisis in 2008, financial stability has also become an important factor affecting interest rates.

After the financial crisis in 2008, the major central banks in the world learned the lesson that monetary policy only focused on inflation targets and paid insufficient attention to financial stability, and began to focus on improving the financial regulatory framework and strengthening macro-prudential management, and their attention to financial stability targets increased significantly. In terms of macro-prudential management framework construction, the Bank of China is at the forefront of global central banks, and further accelerates the improvement of the dual-pillar regulatory framework of monetary policy and macro-prudential policy after the crisis. Among them, the former focuses on maintaining economic and price stability, while the latter focuses on maintaining financial stability. Under the background of resolving financial risks and maintaining the stability of macro leverage ratio, financial regulatory policies have also become an important factor affecting the level of domestic interest rates. During the period of steady economic growth, especially during the economic recovery cycle, strict supervision and the policy tendency of reducing leverage will lead the market interest rate to rise. For example, in 2013-2014 and 2016-2018, two rounds of domestic interest rates went up, and the tightening of financial supervision was one of the main reasons.

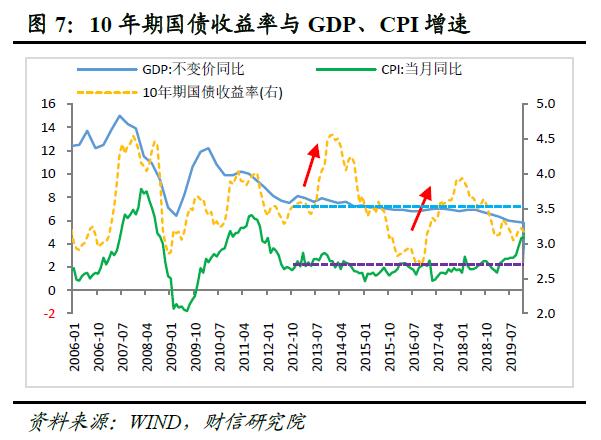

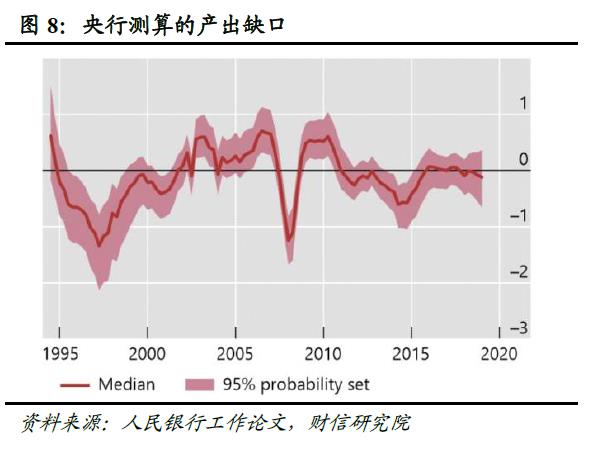

First, the above two rounds of interest rate hikes are in the rising stage of inventory cycle and nominal GDP growth rate (see Figure 4), indicating that economic stabilization and recovery is an important prerequisite for interest rate hikes.However, if we look at the constant price GDP growth rate and CPI growth rate indicators, they have basically changed little during the period (see Figure 7), reflecting that there is no overheating risk in the economy, and fundamental factors are not enough to support a sharp rise in interest rates. The central bank’s working paper "Natural Interest Rate in China" has also reached a similar conclusion, that is, except for a slight decline around 2015, the domestic output gap in 2012-2019 is close to zero (see Figure 8), indicating that the economic operation is generally stable.

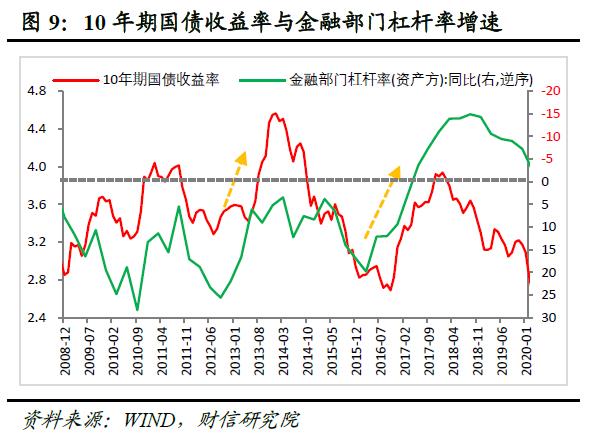

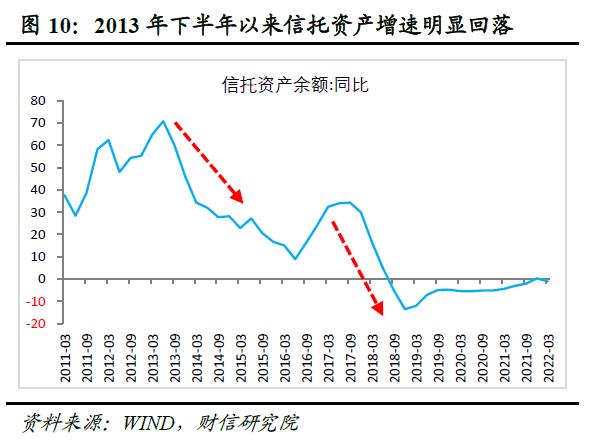

Second, the rapid rise of interest rates in mid-2013 and the end of 2016 is closely related to the shift of monetary policy to deleveraging to prevent risks and the tightening of regulatory policies.During the above two rounds of interest rate hikes, the growth rate of leverage ratio in the financial sector declined (see Figure 9). Among them, in 2013, in order to strictly control banks’ off-balance-sheet loans (such as trust loans) to promote the disorderly expansion of non-standard assets (see Figure 10), and to prevent the rapid growth of interbank business from idling funds within the financial system and increasing the risk of maturity mismatch, the regulatory authorities issued a series of regulatory measures, such as the Notice on Regulating the Investment Operation of Commercial Banks’ wealth management business (referred to as Circular No.8), which forced financial institutions to strengthen liquidity management and added a "default door" for a bank. In 2016, as the economy entered a new round of upward channel, and there were many problems of leverage and capital idling in the financial market, the primary goal of domestic monetary policy gradually shifted from steady growth to risk prevention. At the same time, the 19th National Congress of the Communist Party of China took preventing and resolving major risks as the first of the three tough battles. In October 2016, the Politburo meeting clearly put forward "focusing on curbing asset bubbles and preventing economic and financial risks". In November 2017, new regulations on asset management were introduced, which started the domestic financial deleveraging campaign, and the leverage ratio growth rate of financial institutions increased from 20 in early 2016.

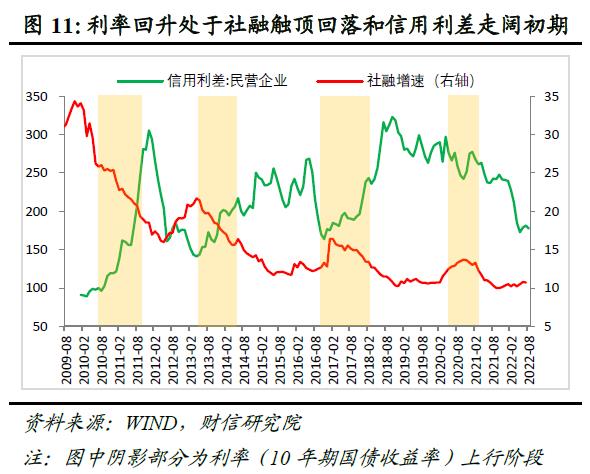

Looking back at the above two rounds of interest rate upward cycles, it is inseparable from the tightening of financial supervision policies. The deep-seated reason behind it is that when the economy is under great downward pressure, the central bank will often implement a loose policy of "releasing water to raise fish" to stimulate the economic recovery. At that time, the market liquidity is abundant but the return of the real economy is low, and the phenomenon of "asset shortage" is prominent, resulting in excess funds speculating on various virtual assets, chasing high-term spread assets, amplifying financial leverage and pushing up financial risks. However, when the economy starts to stabilize and rebound, the regulatory authorities will take the initiative to tighten monetary policy, resolve the risks bred in the early stage and reduce the policy sequelae, thus pushing interest rates upward. Therefore, the interest rate recovery is often in the period after the growth rate of social financing has recovered for a period of time or at the stage of bottoming out, that is, after the economy has stabilized and recovered, the convergence of liquidity at this time will also lead to the bottoming out of credit spreads (see Figure 11).

(3) The interest rate level will also be affected by other factors such as exchange rate, capital supply and demand.

First, monetary policy should not only achieve internal balance, but also take into account external balance, especially with the continuous improvement of China’s capital market opening level, it is necessary to maintain the basic stability of the RMB exchange rate at a reasonable and balanced level, so exchange rate factors have certain constraints on the central bank’s interest rate policy, although this constraint tends to weaken with the increase of exchange rate flexibility.According to "impossible trinity" theory, monetary policy must give up some independence when allowing capital to flow freely and keeping the exchange rate relatively stable. For example, when the Fed enters the interest rate hike cycle, the US dollar index strengthens, attracting international capital to return; If other economies do not follow the tightening of monetary policy, they will often face greater capital outflow and exchange rate depreciation pressure, thus aggravating the domestic capital market turmoil.

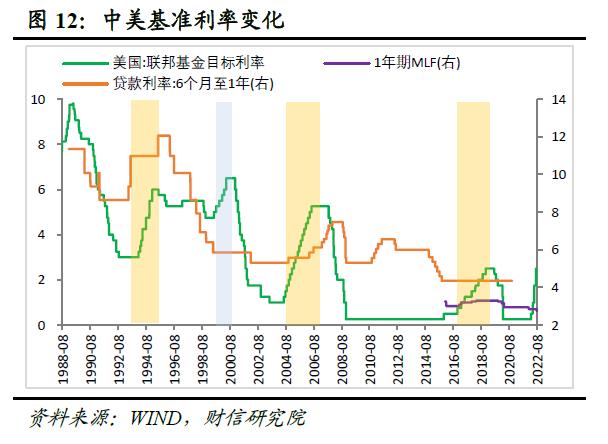

From the domestic practical experience, from 1989 to 2019, the Federal Reserve started four interest rate hike cycles, in which the domestic interest rate increased in different degrees three times, and only in 1999-2000 did China keep the interest rate unchanged (see Figure 12).The main reason why the interest rate did not move was that the GDP growth rate dropped from 9.1% in the fourth quarter of 1989 to 6.7% in the fourth quarter of 1999, and the sharp economic downturn did not support monetary tightening. In 2022, the Federal Reserve started the interest rate hike cycle again, and the domestic monetary policy was "I-oriented", which lowered interest rates, partly due to the increase in exchange rate flexibility, which improved the flexibility and operational space of monetary policy, but this did not mean that domestic monetary policy was not affected and constrained by the Fed’s interest rate hike.

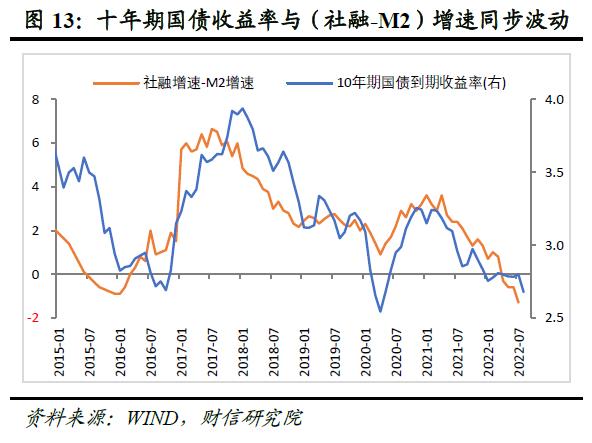

Second, the supply and demand of funds will have an impact on the short-term fluctuation of interest rates.If the money supply and social financing scale represent the macro-level social capital supply and demand respectively, then the difference between the growth rate of social financing and money supply indicates the relative change of capital demand and supply. The bigger the difference, the more the demand for funds exceeds the supply, the more obvious the tension of funds in the market, and the more the interest rate of funds will rise, and vice versa. Empirical data does confirm this point. Since 2015, the difference (social financing growth rate -M2 growth rate) and the yield of 10-year government bonds have fluctuated obviously and have a high correlation (see Figure 13).

An interesting phenomenon is that since 2011, the 10-year bond yield has a high linkage with social financing, but the correlation with the change of money supply has obviously decreased (see Figure 14).Theoretically speaking, the growth rate of M2 should be inversely related to the interest rate, but this relationship is obviously weakened after 2011. The main reasons behind this are as follows: On the one hand, with the acceleration of domestic interest rate marketization, coupled with the rapid development of financial innovation and disintermediation, China’s monetary control mode is gradually shifting from monetary quantity control to price control, which leads to the weakening of the correlation between money supply and economic growth and interest rate level; On the other hand, the money supply M2 reflects more how strong the countercyclical policy is than the growth of the real economy. Different from M2, the yield of 10-year treasury bonds is consistent with the growth rate of social financing, which reflects that the domestic interest rate depends more on the financing demand of the real economy, and the financing demand is behind the growth of the real economy, especially the strong and weak changes of domestic demand. In the final analysis, economic growth is still the decisive force leading the trend of medium and long-term interest rates.

(4) Summary

To sum up, the domestic interest rate level is determined by the multiple objectives of monetary policy, but the core factors that affect our interest rate level at present are still economic growth and inflation, and with the obvious slowdown of domestic price fluctuations in recent years, the former plays a leading role in determining the direction of interest rate changes. In addition, factors such as financial stability and exchange rate can not dominate the direction of interest rate changes, but will strengthen the trend of interest rate changes and increase its fluctuation range. When the economy is in the recovery channel, financial risk prevention and other goals will push interest rates up; When the economy is in a downward cycle, financial risk prevention, exchange rate stability and other goals need to make way for economic growth, and interest rates generally fluctuate and fall.

Second, the short-term trend of domestic interest rates: first, the fluctuation bottomed out, and then the probability of recovery was too high.

(A) Based on the interest rate analysis framework: the yield of 10-year treasury bonds may bottom out first and then rise.

1. The probability of weak economic recovery in the second half of the year is too high, which makes it difficult for interest rates to rise sharply in the short term.

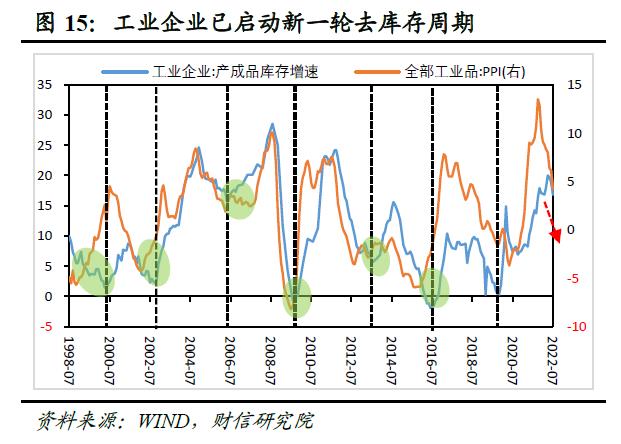

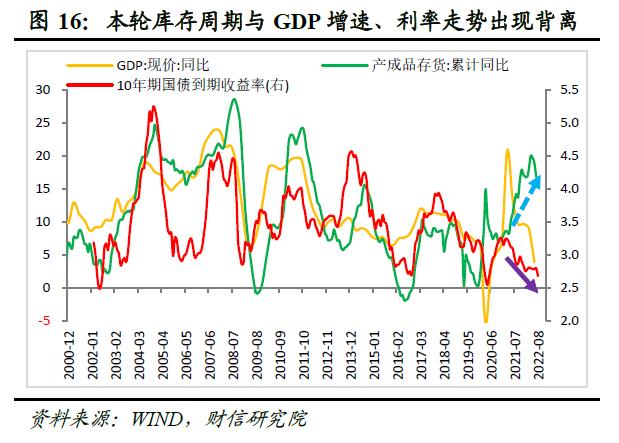

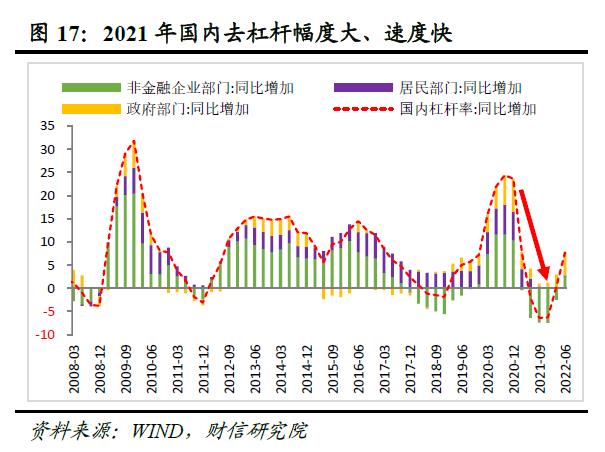

Whether the PPI price index has dropped first or the current replenishment time has reached the highest level in history, it is a high probability event for China to enter a new round of destocking cycle in the future (see Figure 15). What needs to be pointed out here is that since 2021, the growth rate of domestic inventory has been greatly deviated from the growth rate of GDP and the trend of interest rate level, that is, while enterprises replenish inventory, the economic growth rate has dropped rapidly and sharply, and the interest rate has also dropped (see Figure 16). The reason is that the macro-and micro-policies have been tightened simultaneously in 2021, which has led to the rapid and substantial reduction of the leverage ratio of entities (see Figure 17). Coupled with the epidemic disturbance this year, demand has shrunk rapidly and inventory has been passively improved. Therefore, to judge the future trend of economy and interest rate, we need to comprehensively consider many factors such as inventory cycle, epidemic situation and counter-cyclical policy, and we can’t just observe one indicator of inventory cycle.

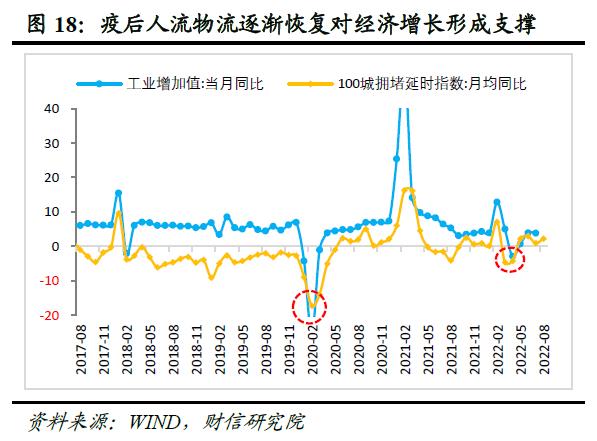

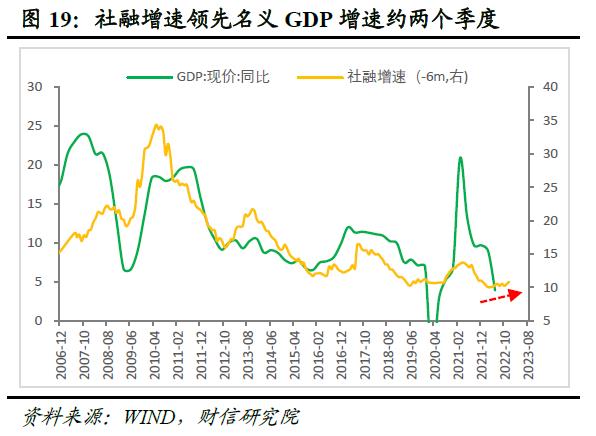

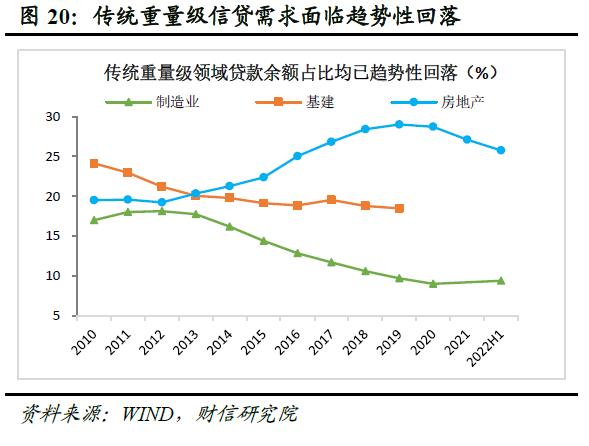

It is expected that the probability of weak economic fundamentals in the second half of the year is too high, which makes it difficult for interest rates to rise sharply.First, with the marginal alleviation of the short-term impact of the epidemic, the recovery of people flow and logistics, and the slight stabilization and recovery of the growth rate of social integration, the leading indicator of the economy (see Figure 18-19), the marginal recovery of the domestic economic growth rate in the second half of the year can be expected from the "deep pit" of 0.4% (constant price) in the second quarter. Second, the inventory cycle has entered a new round of decline channel, which will inevitably restrict the economic recovery. Third, although the growth rate of domestic social integration has stabilized and rebounded, the structure mainly relies on the financial front, and the credit growth rate is still falling, reflecting that the problem of insufficient effective social demand is severe and the economic recovery should not be overestimated. Looking at the extended cycle, China’s credit growth has been difficult in recent years, mainly due to the weakening trend of infrastructure and real estate, which used to have a large credit demand (see Figure 20), while the demand for other loans with relatively small volume is difficult to make up for the credit demand gap, which leads to the decline or normalization of China’s credit growth rate during the shift of new and old kinetic energy, which also means that the mode of stimulating economic growth by financial expansion is unsustainable, and it is necessary to cultivate new kinetic energy and new social purchasing power, create new credit demand, and smoothly spend the shift of growth rate.

2. Short-term inflationary pressure rises, which supports the upward trend of interest rates.

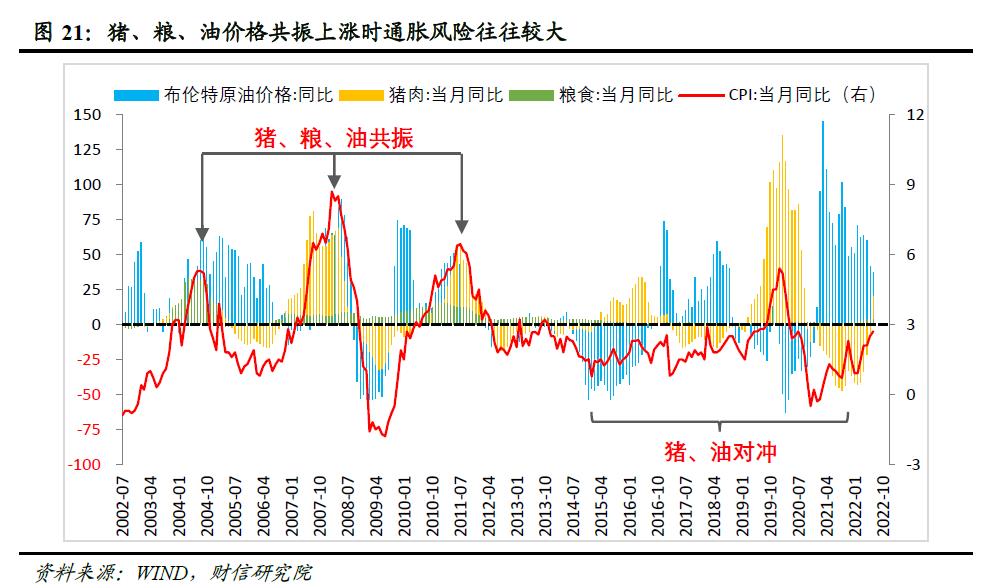

According to historical experience, when the domestic prices of pigs, oil and grain rise in resonance, the inflationary pressure tends to be greater (continuously exceeding the inflation target of 3%). On the contrary, if the prices of pigs and oil hedge each other and the food price is moderate, the inflation risk is relatively small and the time for the price to continue to rise is relatively short (see Figure 21).

Looking into the future, influenced by factors such as the resonant upward trend of pig food prices, the high oil prices, the recovery of consumer demand and abundant liquidity, it is expected that CPI will continue to fluctuate around 3% or even above 3% from the second half of this year to the first half of next year, which will support the upward trend of interest rates.

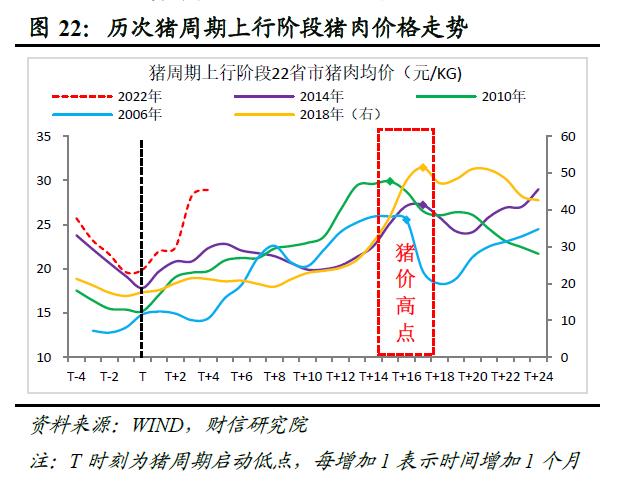

First, a new round of "pig cycle" has been launched, and this round of pig price increase is second only to the African swine fever period in 2019.Historical experience shows that each round of "pig cycle" in China lasts about four years, and the first 1.5-2 years are the upward period of prices. In April this year, the domestic pork price went down to the stage low point, which is about four years from the starting point of the last cycle. Since May, the pig price has continued to rise, indicating that a new round of "pig cycle" has started, and it may usher in an upward period of more than one year in the future. Judging from the increase of this round of pig cycle, due to the weak demand recovery and the slow speed of supply, it is expected that the increase of pig price in this round will hardly exceed that of African swine fever in 2019. However, at the end of July, the average price of pork in 22 provinces and cities has risen to 29 yuan/kg, and extreme weather may have a certain negative impact on the supply of pigs. In the future, the pig price will probably continue to rise moderately (see Figure 22), and the increase is expected to exceed several rounds of pig cycles that began in 2006, 2010 and 2014.

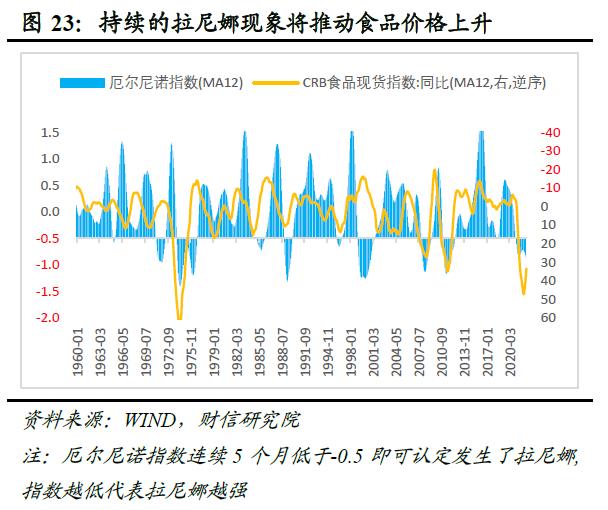

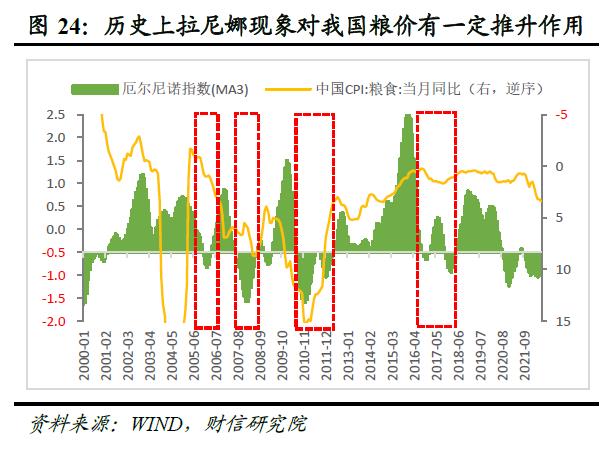

Second, the rise of international food prices is superimposed on extreme weather, and the risk of food price fluctuation in China may increase in the future.Benefiting from the low dependence of China’s three staple foods on foreign countries and sufficient domestic stocks, the increase in international food prices in the first half of the year has relatively little impact on China, which mainly drives domestic CPI through cost channels. However, two factors may increase the risk of food price fluctuation in China in the future. First, the negative impact of the Russian-Ukrainian conflict on global food prices, such as reduced grain production, rising grain production costs and slowing food trade, has yet to be revealed. In addition, the rise of food protectionism (the number of countries that issued food export bans in 2022 was as high as 24, second only to the 28 in 2008 food crisis), it is hard to say that the warning of future global food crisis has been lifted. Second, the impact of extreme weather on the global and China’s food prices may have increased: on the one hand, according to the statistics of the United States Oceanic and Atmospheric Administration, July this year was the second hottest July in the world since statistics were available in 1880, and China also ushered in the hottest summer since statistics were available in 1961. It is expected that the negative impact of high temperature and dry weather on food production will gradually emerge; On the other hand, the US Oceanic and Atmospheric Administration predicts that there is a 60% probability that La Nina will continue from December 2022 to February 2023, which means that a rare "triple" La Nina climate event may occur this year, and the world will face the test of cold winter, or further push up the global and Chinese food prices (see Figure 23-24).

Third, international oil prices may continue to fluctuate at a high position, and China’s imported inflationary pressure still exists.For example, geopolitical conflicts and global energy transformation will restrict the improvement of this round of crude oil supply, and the cold winter weather is expected to partially hedge the impact of the decline in crude oil demand brought about by the global economic downturn. It is expected that oil prices will fluctuate at a high position in a high probability during the year.

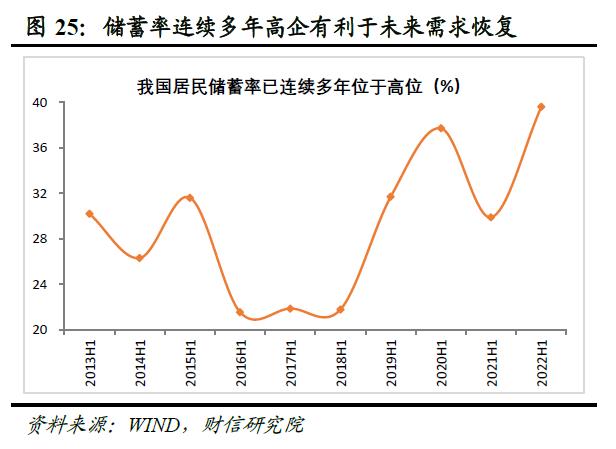

Fourth, abundant domestic liquidity and improved consumer demand will also support the rise of CPI center. On the one hand,Economic recovery after the epidemic is conducive to reducing the unemployment rate and increasing residents’ income, thus boosting residents’ consumption ability and willingness. In addition, after the epidemic is controlled, the consumption scene has improved, and residents have accumulated rich savings in the early stage (see Figure 25), which has accumulated energy for future consumption demand recovery.On the other hand,Since the second half of last year, the domestic money supply has been loose, and the growth rate of M2 has increased from a low of 8.2% in August last year to 12% in July this year, which is much higher than the nominal GDP growth rate, setting a new high since the outbreak, and will also support the rise of CPI center.

3. The continuous upside-down spread between China and the United States and the transformation of wide currency into wide credit will also increase the upward pressure on interest rates.

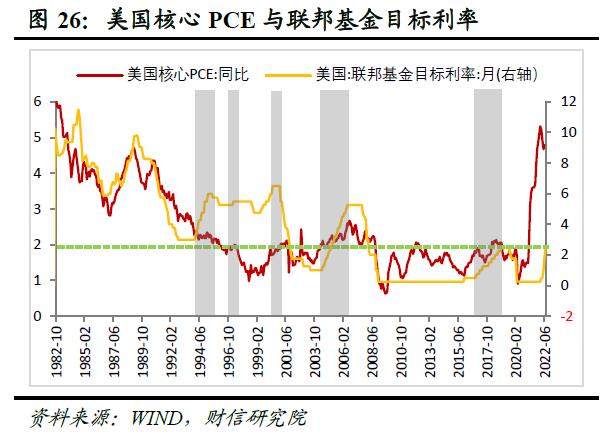

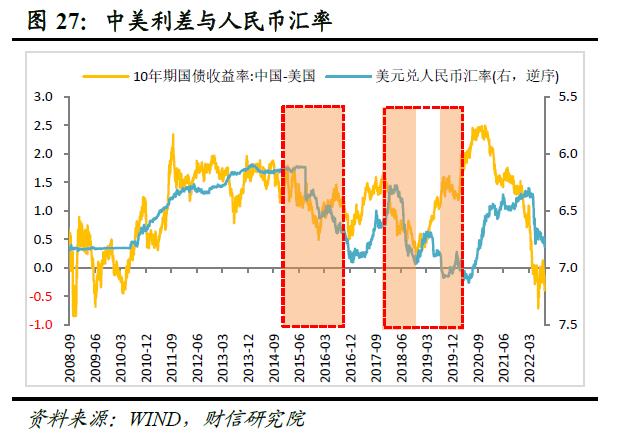

First, the spread between China and the United States may remain upside down for a long time, which will increase the upward pressure on interest rates through exchange rate channels.Affected by high inflation, the Fed has raised interest rates four times during the year, raising the target interest rate of the federal funds from 0-0.25% to 2.25-2.5% (see Figure 26), and the Fed is still on the way to continue raising interest rates during the year. During the same period, the pressure of steady growth of domestic economy was great, and interest rates were cut twice during the year. The dislocation of financial cycles between China and the United States deepened, and the yields of 10-year government bonds of the two countries continued to be upside down. This trend will continue in the short term. According to historical experience, the falling or even upside-down spread between China and the United States will increase the depreciation of the RMB exchange rate and the pressure of capital outflow (see Figure 27). In order to take into account the external balance, domestic monetary policy easing will be restrained to some extent.

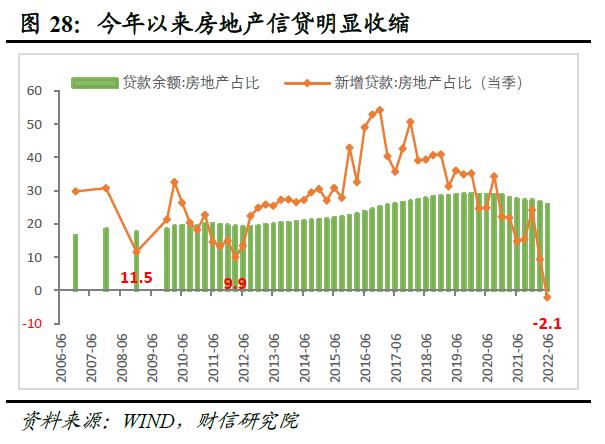

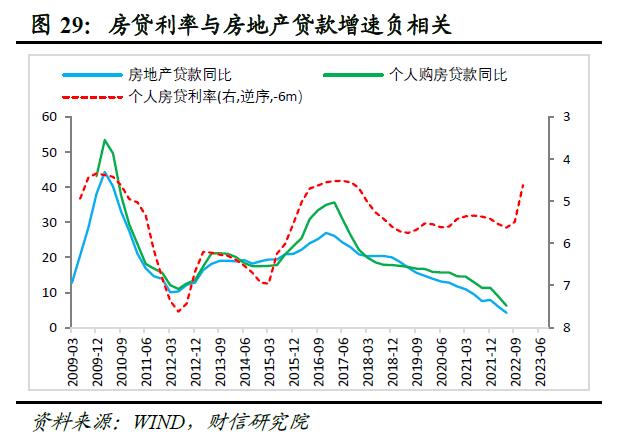

Second, with the transformation from a wide currency to a wide credit, it will also restrict the downside of interest rates.Since the beginning of this year, domestic real estate-related credit has shrunk sharply, and the proportion of new real estate loans to all new credit has turned negative in the second quarter (see Figure 28), indicating that the repayment scale of residents and housing enterprises has exceeded the amount of real estate loans lent by banks. Affected by this, the transmission of domestic wide money to wide credit has been impeded. In July, the difference between the growth rate of social financing and the growth rate of M2 hit a new low since statistics were available (see Figure 14). However, in the future, the positive factors have increased significantly. For example, after the 5-year LPR interest rate was lowered by 15BP again on August 22, the domestic personal housing loan interest rate may have been lower than the 2016 low, only slightly higher than that after the 2008 financial crisis. Generally speaking, the mortgage interest rate is about 6 months ahead of the growth rate of real estate loans. Since the beginning of this year, the domestic mortgage interest rate has continued to fall rapidly, which indicates that the growth rate of real estate loans is expected to gradually stabilize and pick up in the future (see Figure 29). With the gradual recovery of real estate credit from a very low position and the continuous efforts of "one city, one policy", the transformation from wide currency to wide credit is expected to accelerate, which will restrict the downward space of interest rates in the future.

To sum up, the economic recovery is weak and the regulatory policies are difficult to tighten, but the inflationary pressure is increasing, the spread between China and the United States continues to be upside down, and the wide currency is transformed into wide credit. It is expected that the interest rate will have limited room for further decline in the current position. In the next few quarters, the domestic 10-year national debt income will be the first to oscillate and bottom out, and the probability of rising later is too high.

(B) Based on quantitative analysis: the current yield of 10-year treasury bonds is lower than the desired interest rate, and the high probability gradually converges upward.

In the medium and long term, the market interest rate should be equivalent to the desirable interest rate level that can not only ensure the economic operation at the potential output level, but also achieve the goals of price stability, full employment and financial stability. In this paper, the general Taylor rule method is used to measure the desirable interest rate level in China, and it is compared with the market interest rate to see whether there is overshoot at present, and thus to judge the future market interest rate trend.

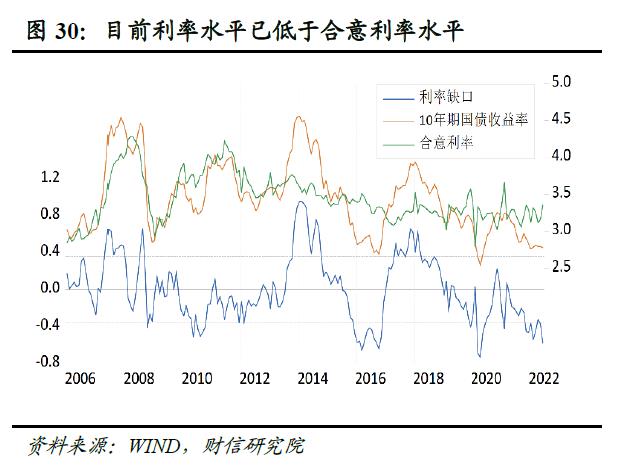

According to Taylor rule, the interest rate level is mainly determined by inflation gap and output gap. With the diversification of the central bank’s monetary policy objectives and the development of financial markets, we add exchange rate and social financing scale factors to the basic Taylor rule to fit and measure the current acceptable level of China’s 10-year national debt yield. Taylor’s rule regression equation shows that the current yield level of ten-year treasury bonds is obviously lower than the desired interest rate level (see Figure 30), which means that the interest rate level is lower than the desired interest rate level that matches the current economic growth, prices, exchange rate and liquidity. According to past experience, when the interest rate gap (market interest rate-desirable interest rate) falls below -0.4%, the probability of market interest rate converging upward to desirable interest rate is greater, and it is only a matter of time before the market interest rate rises in the future.

(3) Based on historical experience: If there is no unexpected impact, the interest rate will fall first and then rise after the interest rate cut boots land.

No matter from the economic fundamentals or quantitative point of view, we all think that the interest rate will converge marginally in the future with a high probability, but the market is still skeptical about whether the interest rate will really go up. There is an important reason behind it, that is, the economic data in July was significantly less than expected, and after the loan suspension risk incident, the central bank unexpectedly lowered the policy interest rates of MLF and OMO on August 15, which rekindled the market’s expectation of starting a new round of interest rate reduction cycle in China.

Historical experience does show that after the central bank cuts interest rates continuously, the market interest rate will tend to decline in the short term, but it also shows that as long as the credit data improves and the economy gradually stabilizes after the interest rate cut, the yield of 10-year government bonds will open the recovery channel after the interest rate cut boots land. For example, in 2012 and 2019, there were unexpected interest rate cuts, but after that, interest rates rebounded with the improvement of the economy, rather than falling. Therefore, there is great uncertainty about whether to continue to cut interest rates after cutting interest rates, depending on the marginal changes in economic fundamentals.

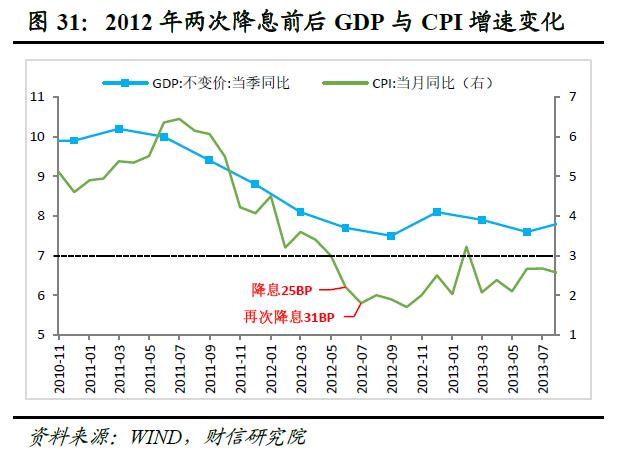

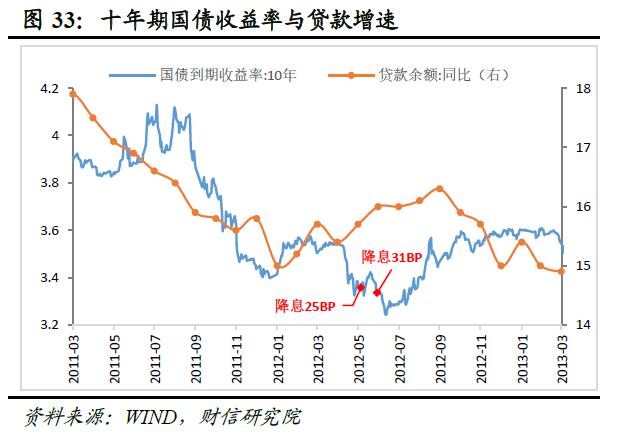

1. In 2012, interest rates were cut twice in a row: the yield of ten-year government bonds only dropped by 14BP, and then the journey of recovery began.

After the second quarter of 2011, the domestic economy continued to slow down. However, because the CPI has been above 3%, the central bank is cautious in cutting interest rates, mainly by lowering the RRR to hedge the downward pressure on the economy (see Figure 31-32). Until mid-2012, with the CPI growth rate falling below 3%, coupled with the superimposed influence of the economic downturn, repeated wide credit (see Figure 33) and the further intensification of the European debt crisis caused by bank runs in overseas Greece, the central bank cut interest rates twice in June and July respectively (see Figure 32). After two interest rate cuts, the cumulative maximum downward rate of 10-year treasury bond yield is about 14BP. However, as the credit growth rate announced after the interest rate cut returned to the upward trend, the economy gradually confirmed its stabilization, and the yield of 10-year government bonds began to turn upside down, starting an upward cycle (see Figure 32-33).

2. Unexpected interest rate cut in 2019: The yield of ten-year government bonds fell by about 9BP, and the downside was reopened after the outbreak of the epidemic.

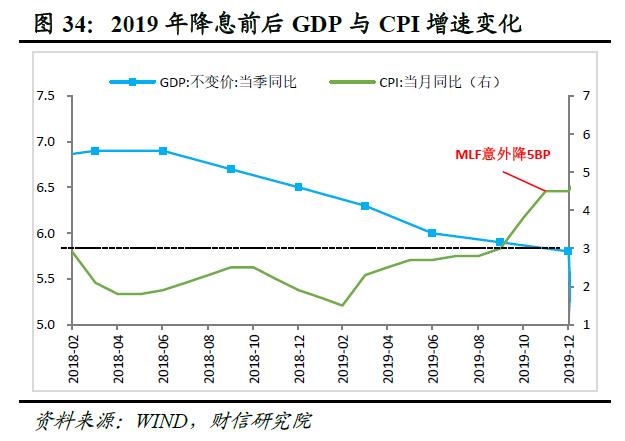

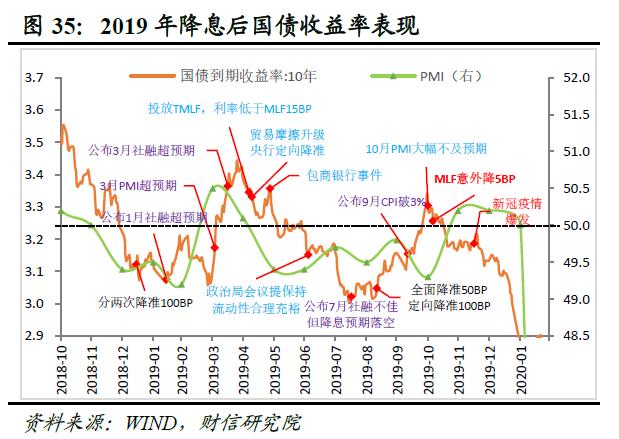

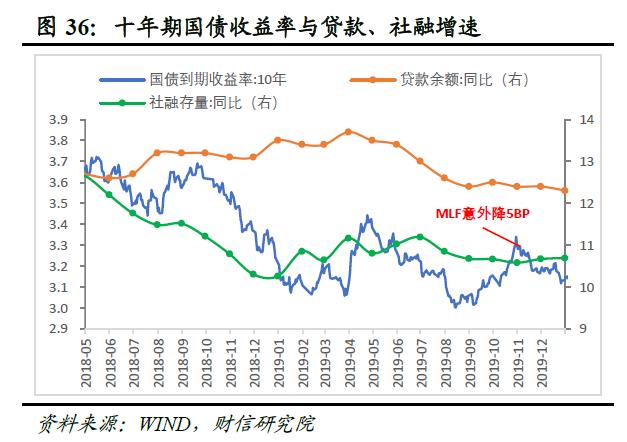

After the second half of 2018, the domestic economy continued to slow down, and the CPI growth rate was less than 3% in the same period (see Figure 34). In order to prevent financial risks, the central bank was more cautious about interest rate cuts, and also chose to lower the RRR first to hedge the downward pressure on the economy (4 RRR cuts in 2018 and 5 RRR cuts in 2019), which promoted the growth rate of domestic social integration and credit to continue to rise to March 2019. However, due to the escalation of trade friction and the occurrence of risk events such as Baoshang Bank, the domestic credit contraction pressure increased significantly in 2019, and the credit growth rate dropped again after the first quarter of the same year. At the same time, the PMI index was below 50% of threshold for six consecutive months, and the downward pressure on the economy increased (see Figure 35-36). Therefore, although the CPI growth rate broke through 3% from September to October in 2019 (the soaring pork price increased the structural inflationary pressure), after the PMI fell to 49.3% in October, hitting an eight-month low, the central bank cut the MLF interest rate by 5BP in early November (see Figure 35). After the interest rate cut, the yield of 10-year treasury bonds dropped by about 9BP, and then gradually stabilized. At the end of December, the COVID-19 outbreak broke out in China, which further reopened the downward space of interest rates (see Figure 35).

To sum up, during the economic downturn in 2012 and 2019, the central bank was cautious about cutting interest rates at first. However, due to some unexpected risk events, continuous credit contraction and sustained downward pressure on the economy, the central bank still took interest rate cuts at the end of the economic downturn, and the timing of interest rate cuts exceeded market expectations. Both rounds of interest rate cuts pushed interest rates down slightly in the short term, but in 2012, as the economy stabilized, interest rates quickly turned upward, and the outbreak of the epidemic in 2019 further opened up the downside of interest rates.

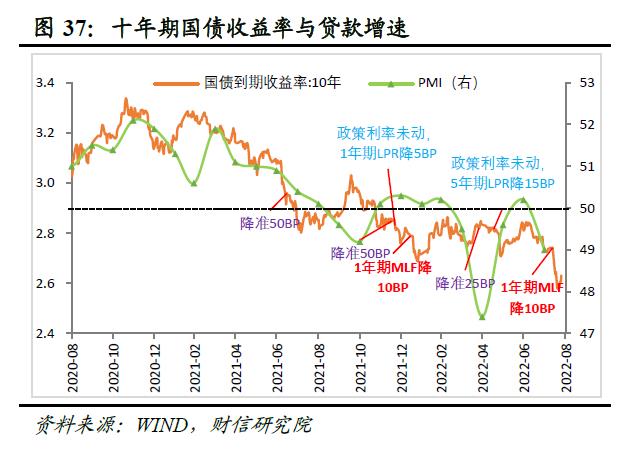

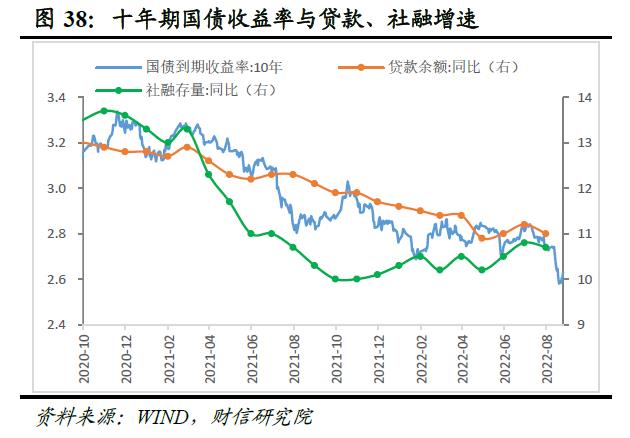

Similar to 2012 and 2019, in 2022, the central bank was also cautious about comprehensively lowering the policy interest rate. For example, after the interest rate was cut by 10BP in January 2022, despite the unexpected rebound of domestic epidemic in the second quarter, the central bank did not immediately reduce the policy interest rate. It was not until July that the economy turned downward again on the way to recovery and there were twists and turns in credit easing that the central bank cut interest rates again beyond expectations (see Figure 37-38). According to the experience of two rounds of interest rate cuts that exceeded expectations in 2012 and 2019, if the domestic economy gradually stabilizes in the short term, the transformation from wide currency to wide credit accelerates, and the yield of 10-year government bonds drops slightly, the recovery channel will be gradually started; If there is an unexpected risk event, such as the real estate recovery continues to be less than expected, the risk spreads to other fields or even systemic risks, it is also expected that the central bank will cut interest rates quickly, continuously and substantially, and the interest rate center is expected to drop significantly again until the economy stabilizes, but at present, this probability is too small.

(4) Summary

Based on the analysis of the above three perspectives, it is estimated that the yield of domestic 10-year government bonds will probably bottom out first and then rise in the next few quarters:1)The weak recovery of domestic economy does not support a sharp rise in interest rates in the short term, and even does not rule out the possibility of cutting interest rates again. However, with the increasing pressure to stabilize prices and exchange rates, the constraints on monetary easing are also obvious. In addition, with the transformation from a wide currency to a wide credit, the probability of China’s credit demand bottoming out and economic recovery improving in the future will increase. It is only a question of whether the recovery speed or slope can be as expected, and the trend of interest rate recovery is relatively clear.2)At present, the domestic market interest rate has been much lower than the desired interest rate level, and it is only a matter of time before it converges upward;3)Historical experience shows that the interest rate cut on the eve of economic recovery will help the interest rate to decline slightly in the short term, but if there is no unexpected impact, after the interest rate cut boots land and the economy is confirmed to stabilize, the interest rate will open a recovery channel.

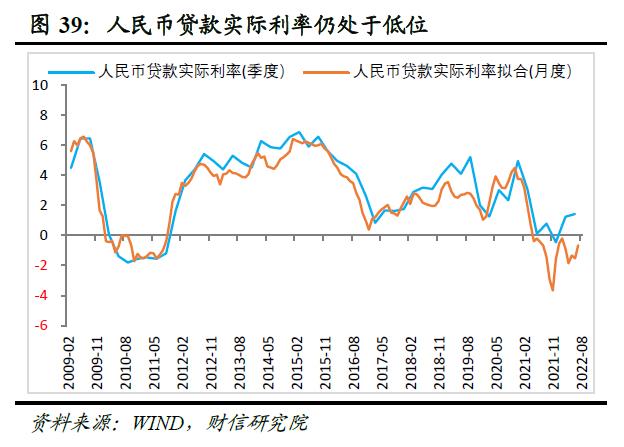

In addition, the current real interest rate level in China is not high, and monetary policy is constrained by insufficient demand. The effect of monetary easing on stimulating economic growth is limited, but it may bring more sequelae. Unless it encounters extreme unexpected shocks, it is not necessary to continue to loosen the currency substantially. First, China’s real interest rate (nominal interest rate minus inflation rate) has been continuously lower than the actual economic growth rate. Governor Yi Gang of the Central Bank pointed out in the article "Interest Rate System and Interest Rate Marketization Reform in China" that the real interest rate R after inflation adjustment should be equal to the real economic growth rate G. However, most of the time, the real interest rate in China is lower than the actual economic growth rate, which tends to distort the allocation of financial resources and bring about inflation, asset price bubbles, idle funds and other problems. At present, the real interest rate of RMB loans in China has been at a low level below 1.5% for five consecutive quarters (see Figure 39), and the growth rate has been lower than the real GDP except for the second quarter of this year. Second, the core contradiction facing China’s economy at present is insufficient effective demand. Monetary easing is constrained by banks’ reluctance to borrow and enterprises’ reluctance to borrow, and it is difficult for monetary policy to promote the "soft rope". Therefore, fiscal policy needs more efforts. Monetary policy should cooperate with fiscal policy to provide suitable liquidity and financing environment, and blindly easing will not help accelerate the optimization and adjustment of the current economic structure.

This article was first published on WeChat WeChat official account: Seeing the Macro. The content of the article belongs to the author’s personal opinion and does not represent Hexun.com’s position. Investors should operate accordingly, at their own risk.