Tenet also has a national version, and the original translated film can be opened like this

Special feature of 1905 film network The information is too dense to understand? The second brush can consider the national version! Many viewers said in Weibo that Ershua hopes to choose.Mandarin dubbing version, by"Without the trouble of reading subtitles, you can focus on the plot and solving puzzles."

The dubbed version of Tenet Mandarin was translated by Changchun Film Studio, directed by Wang Xiaowei, and voiced by Zhao Xin, Meng Lingjun and Yang Ming respectively.

When it comes to translated films, most of us will recall the golden age of 1970s and 1980s. Zhang Yukun, Tong Zirong, Bi Ke, Liu Guangning, Xiang Juanshu and other voice actors of the older generation interpreted countless classic lines and roles, which constituted a common memory of the times for a generation.

Nowadays, with the change of the younger generation’s viewing habits, is the translated film no longer beautiful? How to make young audiences truly feel the charm of film dubbing art?

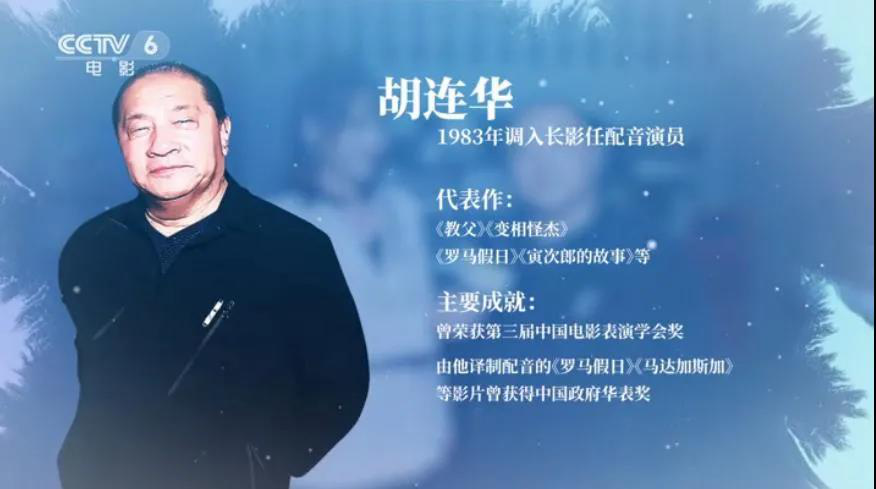

During the 15th Changchun Film Festival·China, we also made a special trip to Changying Translation Studio to get a close look at the charm of film translation under the leadership of the director Wang Xiaowei and the famous voice actor Lianhua Hu.

From Part One to Part 2666

Classics and inheritance of translated films

Entering the exhibition hall of Changchun Film Translation Studio, the shining number "2666" on the wall is particularly eye-catching.

As the birthplace of film translation in New China, Changying Translation Studio has translated 2,666 films from 50 countries since 1949.

Among them, there are not only Ordinary Soldier, the first translated film of New China, but also classic films such as Francis.

In recent years, the translation and distribution of Hollywood blockbusters such as Tenet are also produced by Changying Studio.

Lianhua Hu, a well-known voice actor, joined Changying Translation Studio in 1983 and has dubbed more than 1,100 films so far, including Roman Holiday, The Grinch in disguise and other classic works, which witnessed the golden age, development and inheritance of translated films.

Talking about the behind-the-scenes stories of the old translators such as Ordinary Soldier, what impressed Lianhua Hu most was the rigorousness, hard work and plain living professionalism of the voice actors of the older generation.

Because flammable film was used at that time, it was possible to catch fire after dubbing for more than three times, which also put forward extremely high requirements for actors: they must "recite their lines backwards" without a word or a mouth shape.

Before the official dubbing, actors have to recite words, write personal feelings, analyze roles, polish them for months or even half a year, and some even take bedrolls and live directly in the dubbing shed.

Zhang Yukun, the late famous voice artist who once voiced the leading actor of Ordinary Soldier, once recalled, "I read the lines to the original film over and over again. But I can’t be right. I’m so anxious in winter that I’m sweating. The more anxious I am, the more wrong I am. After repeated attempts, I finally found some tips. "

Most of the older generation of voice actors have no professional foundation, but without exception, they all have the spirit of being willing to endure hardships and study hard, and have explored the doorway of voice-over step by step.

"This is also a revolutionary tradition passed down from generation to generation. Seventy-five years ago, a group of people dressed in homespun uniforms walked from Yan ‘an in northern Shaanxi for more than four months to meet in Changchun, Jilin, to build changchun film studio. This spirit of hard work and simplicity has been adhered to and passed down by Changying Factory. " Lianhua Hu said.

Nowadays, many imported films leave very little time for translation work in order to catch up with the schedule, but Changying has always continued the fine tradition of the film era, and will still organize everyone to watch movies together, analyze roles, try to figure out emotions, and do their homework before dubbing.

Wang Xiaowei, director of Changying Translation Factory, said that the dubbing work of translation producers often needs to work overtime, but no matter whether the actors are old or young, they have no complaints.

"It is common for them to stay in the shed for several hours, ten hours or so. It seems that their life is just in a small room, facing a microphone, but they completely integrate themselves into the film and feel the charm of light, shadow and sound. Macroscopically speaking, this is a career, and microscopically speaking, this is a career. "

Break the stereotype

How to break through the translation?

On the one hand, the dedication and persistence of voice actors, on the other hand, it is an indisputable fact that the market of Chinese-made translation films is shrinking.

In Tenet, for example, there are only 13 cinemas in Beijing showing dubbed versions of Mandarin, most of which are located in suburbs or are not popular cinemas in business districts. This is also the general situation of Chinese-translated films.

On the one hand, the prosperity of subtitle groups has made the younger generation have already developed the habit of listening to the original sound and watching subtitles. Many young viewers believe that the original sound version is more original.

In recent years, a series of "translated tunes" represented by "my old buddy", "you damn it" and "Oh, my God" are often compiled into paragraphs and become the object of netizens’ spit, which also makes many viewers stereotype the "translated films".

In this regard, Lianhua Hu said that in today’s translation work, the first thing is to keep pace with the times and get rid of the "dubbing cavity". "We should use a more grounded language expression, because the film itself is a cultural commodity, and only when we share the same fate with the current audience can we have room for survival."

On the other hand, due to the rush of importing films, the time left for dubbing is often very limited. Time is tight, and the task has become the normal work of this industry.

When dubbing, Peisi Chen once "complained" that the "White Rabbit" was recorded for only one day, lacking sufficient preparation time, and he was "too old to keep up with the strength behind".

Cao Lei, a famous voice actor who participated in the dubbing, also said at the press conference that the dubbing time was relatively hasty, and he had never seen the whole English film, only the fragments of this role.

According to Wang Xiaowei, many Hollywood blockbusters have only a week to 15 days left for translation. After translation, the dubbing director has to "agree", lip-synch a little and adjust his lines. The time really left for voice actors is often only 10 hours.

"At first, everyone didn’t adapt, and felt that time was too short to be finely polished, but we are constantly adjusting our mentality to adapt to this concept of time." Wang Xiaowei said.

In addition, the script and translation level are also important factors affecting the quality of translated films.

Jia Xiuyan, who has translated Hollywood blockbusters, once quoted a famous translator Fu Lei as saying: "Translation is like painting" and thought that "a good translation should be like copying a painting, and the pursuit is not in the form, but in the spirit."

However, at present, film translation is more at the level of "similarity", and it can only be as accurate as possible, but it is still slightly inferior in language color and artistry. Palace-level translation, which can be compared with Mr. Sun Daolin’s classic dubbing clips in his early years, is hard to find.

Happily, in recent years, many high-quality Chinese films have emerged. In the creation of DreamWorks, it is the first time that DreamWorks attempts to remake the mouth shape for foreign language countries and tailor-made dubbing versions.

Not only did we set up a Chinese dubbing team including screenwriter, director and creative consultant, but it also took eight months to polish the localized script and adjust the mouth shape, and finally received good feedback from the audience.

The Chinese-American co-production animation released last year not only showed the scenery of China to the world and told the story of China, but also invited Zifeng Zhang, Chen Feiyu, Wan Qian and Cai Ming to form an all-star dubbing lineup, which was well received.

The dubbed version of Mandarin Chinese has landed in 4,000 cinemas in the United States, delivering the original "China voice" to the world.

Wang Xiaowei said that the future development of Changying Translation Studio will be "multi-legged", not only to do a good job in the translation and distribution of cinema films, but also to continue to maintain cooperation with film channels, and at the same time actively try to dub TV dramas, cartoons and even radio dramas. "I want to turn them into a team that is versatile in all kinds of works, so as to have better development."

In recent years, with the rise of Guoman, the popularity of dubbing programs and the popularity of dubbing software, many dubbing actors have also gone from behind the scenes to "in front of the stage", which has won more attention and respect for the whole industry while gaining fans and applause.

In Japan and Europe, where the film market is highly developed, a large proportion of dubbed films are still released every year, and excellent dubbing actors and seiyuu also have excellent income and high social status, which proves that translated films, as an art form of "re-creation", have their value and significance and will not die out with time.

Polishing the works with meticulous creative attitude, so that the dubbed version can display the unique charm of China language, will definitely make more audiences regain their love for the translated films.